Not all the clients you work with as a real estate agent will be buying, selling, or renting properties under happy circumstances. You’ll also work with clients with difficult questions, such as “When is it too late to stop foreclosure?

Here are the basics of the foreclosure process so that you can educate your clients and advocate for their best interests.

What Is a Foreclosure?

Foreclosure is the legal process in which lenders take possession of a property due to missed mortgage payments. Foreclosure may end in a public sale of the property. As a real estate agent, knowing the stages of foreclosure and how to advise clients can provide immense value and support.

Please note that this article addresses foreclosure due to missed mortgage payments and not foreclosure due to unpaid property taxes.

Key Takeaways

- The foreclosure process has multiple stages, from pre-foreclosure to auction, each offering different options for homeowners to potentially halt the process.

- Depending on the foreclosure stage, homeowners may have options like loan modifications, repayment plans, short sales, or even bankruptcy, but these options diminish as foreclosure progresses.

- Foreclosure timelines and procedures vary by state. Some states require judicial foreclosures that allow homeowners to contest the process in court, while others permit faster non-judicial foreclosures.

- Real estate agents can play a crucial role by educating clients on their options, advocating for communication with lenders, and connecting them with relevant resources to navigate foreclosure effectively.

Key Stages of a Foreclosure

Stopping a foreclosure becomes increasingly challenging as the process advances. Here are the key stages of a foreclosure.

1. Pre-Foreclosure

During this initial phase, homeowners receive notices about missed payments. They may be given a grace period. However, if they can’t pay, they may consider options like loan modification, repayment plans, or refinancing to halt foreclosure.

- Loan Modification: During the pre-foreclosure period, the homeowner may be able to work with the lender to alter the terms of the existing loan. For example, the homeowner may be able to extend their repayment period, reduce interest rates, or roll missed payments into the loan balance.

- Refinancing: For those still with a relatively strong credit score, refinancing with a new loan can help secure a lower interest rate or longer repayment term to reduce monthly payments.

- Forbearance: In cases of temporary financial hardship, a lender may grant forbearance, which allows the borrower to pause or reduce payments for a specified period.

If a client has missed payments and is in the early stages of foreclosure, encourage them to discuss their situation with their lender to see if one of these options is viable.

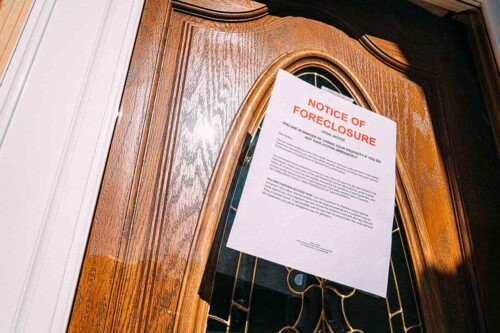

2. Notice of Default (NOD)

The next stage of foreclosure is a NOD or Notice of Default. The NOD often provides the homeowner a window (typically 30 to 90 days) to pay overdue amounts to avoid further action.

A NOD officially starts the foreclosure process. However, at this stage, homeowners can still negotiate repayment plans, offer a deed in lieu of foreclosure, or explore a short sale.

- Deed in Lieu of Foreclosure: In this arrangement, the homeowner voluntarily transfers the deed to the lender to satisfy the mortgage debt. The lender takes ownership without going through the foreclosure auction process. This option can be less damaging to the homeowner’s credit than a foreclosure and may allow for a smoother transition out of the home.

Related Article: What Is Deed in Lieu of Foreclosure?

- Short Sale: A short sale allows the homeowner to sell their home for less than what they owe on the mortgage, with the lender’s permission, to avoid foreclosure. The homeowner won’t make a profit from the sale. However, the process helps them partially settle the debt and avoid a full foreclosure.

Related Article: What Is a Short Sale in Real Estate?

As a real estate agent, you must understand short sales from both the buyers’ and sellers’ perspectives, as well as your state’s laws regarding the process.

3. Notice of Trustee’s Sale or Notice of Sale (NOS)

The NOS formally schedules the foreclosure sale, marking a critical juncture where options to stop foreclosure begin to diminish. The homeowner usually has until a few days before the sale to “cure” the mortgage.

- Loan Reinstatement: Reinstating the mortgage by paying the overdue amount, including any accumulated fees and interest, can still stop the foreclosure. However, the total sum required can be substantial at this point.

- Bankruptcy: Filing for Chapter 13 bankruptcy may delay foreclosure, allowing the homeowner to reorganize their debts and potentially keep their property.

If you encounter a client at this stage of the foreclosure process, you may advise them to consult a financial advisor or attorney specializing in foreclosures.

4. Auction

The lender will attempt to sell the property to recover the mortgage balance, and the auction often marks the final phase in the foreclosure process. Once the property is up for auction, the opportunity to stop foreclosure is severely limited.

Redemption Period: Some states offer a redemption period even after the auction, where the homeowner can reclaim the property by paying the full auction price plus additional costs.

Educating clients on your state’s laws regarding the redemption period can clarify their options. However, agents should emphasize that recovery at this point is highly challenging.

When Is It Too Late to Stop a Foreclosure?

The answer to “When is it too late to stop a foreclosure?” depends on your state. State laws impact the types of foreclosure and, thus, foreclosure timelines.

For example, some states (including Florida, New York, and Ohio) require judicial foreclosure, meaning the lender must file a lawsuit to obtain a court order to foreclose on the property. This gives the homeowner the chance to contest the foreclosure in court.

Other states (including California and Texas) offer non-judicial foreclosure. The foreclosure process moves faster in states with non-judicial foreclosure.

For real estate professionals, understanding these legal nuances enables you to give more accurate guidance. You’ll learn your state’s foreclosure regulations as you complete your pre-licensing education for your real estate license.

Foreclosure Laws by State

Below is a chart summarizing the primary foreclosure process for each state. Please note that some states permit both judicial and non-judicial methods, with one being more commonly used. For example, Hawaii permits both types of foreclosures, but judicial foreclosures are more common. Additionally, certain states have unique procedures; for example, Connecticut and Vermont allow a “strict foreclosure” process, in which the lender can ask the court to transfer the property title directly to them if the homeowner doesn’t pay the owed amount within a specified timeframe. In this scenario, the homeowner forfeits any equity in the property.

| State | Primary Foreclosure Process |

| Alabama | Non-Judicial |

| Arizona | Non-Judicial |

| Arkansas | Non-Judicial |

| California | Non-Judicial |

| Colorado | Non-Judicial |

| Connecticut | Judicial |

| Delaware | Judicial |

| District of Columbia | Non-Judicial |

| Florida | Judicial |

| Georgia | Non-Judicial |

| Hawaii | Judicial |

| Idaho | Non-Judicial |

| Illinois | Judicial |

| Indiana | Judicial |

| Iowa | Judicial |

| Kansas | Judicial |

| Kentucky | Judicial |

| Louisiana | Judicial |

| Maine | Judicial |

| Maryland | Non-Judicial |

| Massachusetts | Non-Judicial |

| Michigan | Non-Judicial |

| Minnesota | Non-Judicial |

| Mississippi | Non-Judicial |

| Missouri | Non-Judicial |

| Montana | Non-Judicial |

| Nebraska | Non-Judicial |

| Nevada | Non-Judicial |

| New Hampshire | Non-Judicial |

| New Jersey | Judicial |

| New Mexico | Judicial |

| New York | Judicial |

| North Carolina | Non-Judicial |

| North Dakota | Judicial |

| Ohio | Judicial |

| Oklahoma | Judicial |

| Oregon | Non-Judicial |

| Pennsylvania | Judicial |

| Rhode Island | Non-Judicial |

| South Carolina | Judicial |

| South Dakota | Non-Judicial |

| Tennessee | Non-Judicial |

| Texas | Non-Judicial |

| Utah | Non-Judicial |

| Vermont | Judicial |

| Virginia | Non-Judicial |

| Washington | Non-Judicial |

| West Virginia | Non-Judicial |

| Wisconsin | Judicial |

| Wyoming | Non-Judicial |

For the most accurate and current information regarding foreclosure processes in your state, consult local laws or a legal professional.

The Role of Real Estate Professionals in the Foreclosure Process

As a real estate professional, your role can extend beyond property transactions to provide support and resources for clients in distress. Here’s how you can help:

- Educate: Inform clients about foreclosure stages, timelines, and possible solutions.

- Advocate: Encourage clients to communicate openly with lenders.

- Connect: Introduce clients to housing counselors, financial advisors, or attorneys specializing in foreclosure prevention.

By positioning yourself as a trusted advisor, you can build stronger client relationships and provide valuable support during one of the most challenging situations homeowners may face.

Of course, you may also represent a client who wishes to purchase a property in foreclosure. It’s up to you to help your client understand the foreclosure process and the challenges of buying such a property. Learn more about the process by reading Negotiation on Foreclosure Properties: Tips for Real Estate Agents.

Are you ready to help clients with one of their life’s most significant financial decisions? Have the backing of an excellent pre-licensing education by enrolling in Colibri Real Estate School. Our at-your-own-pace courses are affordable and will teach you all you need to know to pass your state’s licensing exam and offer top-tier service to your future clients.

Source: Loftsgordon, Amy · University of Denver Sturm College of Law. “Key Aspects of State Foreclosure Law: 50-State Chart.” www.nolo.com, May 23, 2024. https://www.nolo.com/legal-encyclopedia/50-state-chart-key-aspects-state-foreclosure-law.html.